As a designer, I meet a lot of authors that are confused as to their publishing options. Not a surprise. Publishing has changed dramatically. My primary advice is “Do your homework BEFORE you sign on the dotted line!”

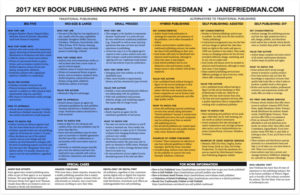

Jane Friedman has done an excellent job in simplifying the various publishing paths. She has provided a downloadable PDF chart of the differences from Traditional to self-publishing.

Publishing Chart: Traditional, Alternative or Self-Publish | Jane Friedman

- Feel free to download, print, and share this chart however you like; no permission is required. It’s formatted to print perfectly on 11″ x 17″ or tabloid-size paper.

According to Jane Friedman’s post “The Key Book Publishing Paths: 2017”, posted May 20, 2017, she has provided a detailed breakdown of the publishing industry from the Big 5 (traditional) to Alternative to Self-Publishing (DIY) and covers basic, important questions:

- Who they are

- Who they work with

- Value for the Author

- How to approach

- What to Watch for

Basic overview of Traditional versus Alternative publishing

- Traditional publishing: I define this primarily as NOT paying to publish. Authors must exercise the most caution when signing with small presses; some mom-and-pop operations offer little advantage over self-publishing, especially when it comes to distribution and sales muscle.

- Alternatives to traditional publishing: I define this as paying to publish or publishing on your own. I’ve broken this down into hybrid publishing models, where a publisher is positioning itself as a hybrid approach between traditional publishing and self-publishing, and self-publishing. With either approach, there’s a risk of paying too much money for basic services, and also for purchasing services you don’t need.

Original Source: https://www.janefriedman.com/key-book-publishing-path/